high iv stocks barchart

IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. Exploring Graf Acquisition Corp.

NFLX 56 8 GG 53 9.

:max_bytes(150000):strip_icc()/dotdash_INV_final-52-Week-Range_Feb_2021-02-40c49fe9287645d5a2b8b0308b77fa5f.jpg)

. H o l i - O f f e r Get upto 35 Discount on Premium Plans Details Subscription Packages Service MyTSR. 10 or 15 minute delay CT. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

In reality though the concepts that comprise option trading are easier to understand than you think. A high IV Percentile means the current IV is at a higher level than for most of the past year. How High Dividend Stocks Steadily Outperform The Rest Of The Market Dividend Dividend Stocks Financial Markets.

Joan Barcelo On Twitter Teaching Physics Educational Resources. Churchill Capital Corp IV has a PB Ratio of 133250. Ordinarily I like IV to be 50 and IVR current IVs level relative to where its been for the past 52 weeks to be.

Fundamental data provided by Zacks and Morningstar. ERIC stock closed at 845 on Friday and the April 9 calls were trading around 47 cents. Ad Were all about helping you get more from your money.

SPDR SP 500 ETF TrustNYSESPY. Shriram Transport Finance Co. High Implied Volatility Call Options 26052022.

High iv stocks barchart. Barchart is pretty good. Which Stocks Have the Highest Option Premium.

The cost of the trade is the price of the stock bought minus the price of the option sold. High Implied Volatility Call OptionsExpiry date-31032022 NSE. High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock.

Lets get started today. Typically we color-code these numbers by showing them in a red color. The total cost of the trade would have been 845 047 or just under 800.

Many traders eyes glaze over attempting to comprehend what is thought to be something way too difficult to ever understand. A stock with a high IV is expected to jump in price more than a stock with a lower IV over the. Compare that to the cost of the trade before the big call buying.

The reason for these poor trading results is most likely because as IV increases so does directional risk. Option premiums change every second so we cant make an evergreen list. By understanding both IV and IV rank you can determine the true nature of a stocks volatility.

View GFORUs stock price price target earnings forecast insider trades and news at MarketBeat. This would occur after a period of significant price movement and a high IV Percentile can often predict a coming market reversal in price. A walk through of what I consider the most important concept.

To find company with good fundamentals Im using Barchart stock screener to filter for medium to large size companies with stock price greater then 20 and have high growth rates. Churchill Capital Corp IV does not have a long track record of dividend growth. Hlc Bars Barchart Com.

If IV Rank is 100 this means the IV is at its highest level. Volume reflects consolidated markets. The only winning trade investing 10 with high IV Rank resulted in a 3 return over 11 years and that does not include commissions.

In the past three months Churchill Capital Corp IV insiders have not sold or bought any company stock. The Top Signal Direction page lists those ETFs who are rated to be in the top 1 based on their signal direction. High Implied Volatility Call Options 28042022.

Lets run the stock screener with the following filters. Only 923 of the stock of Churchill Capital Corp IV is held by institutions. If I dont like the default columns of the results I can set up my own custom view with a variety of metrics and apply that to the result listing.

After commissions it also lost money. Just like it sounds implied volatility represents how much the market anticipates that a stock will move or be volatile. Download historical prices view past price performance and view a customizable stock chart with technical overlays and drawing tools for CCIV at MarketBeat.

It is an important factor to consider when understanding how an option is priced as it can help traders determine if an option is fairly valued undervalued or overvalued. The current IV compared to the highest and lowest values over the past 1-year. Signal strength can be used as an indicator of the long-term view of a market whereas signal direction can be used a.

Implied volatility is a theoretical value that measures the expected volatility of the underlying stock over the period of the option. Are you thinking about adding Churchill Capital Corp IV NYSECCIV stock to your portfolio. But what we can do is point you to a list that updates every day.

Open Interest Barchart Com. Since the price of an option is the same as its premium this. 15 20 minute delay Cboe BZX is real-time ET.

Friday March 11 2022. Therefore there is no advantage to selling high IV the way that. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

If the IV30 Rank is above 70 that would be considered elevated. Market Data powered by Barchart Solutions. Traders should compare high options volume to the stocks average daily volume for clues to its origin.

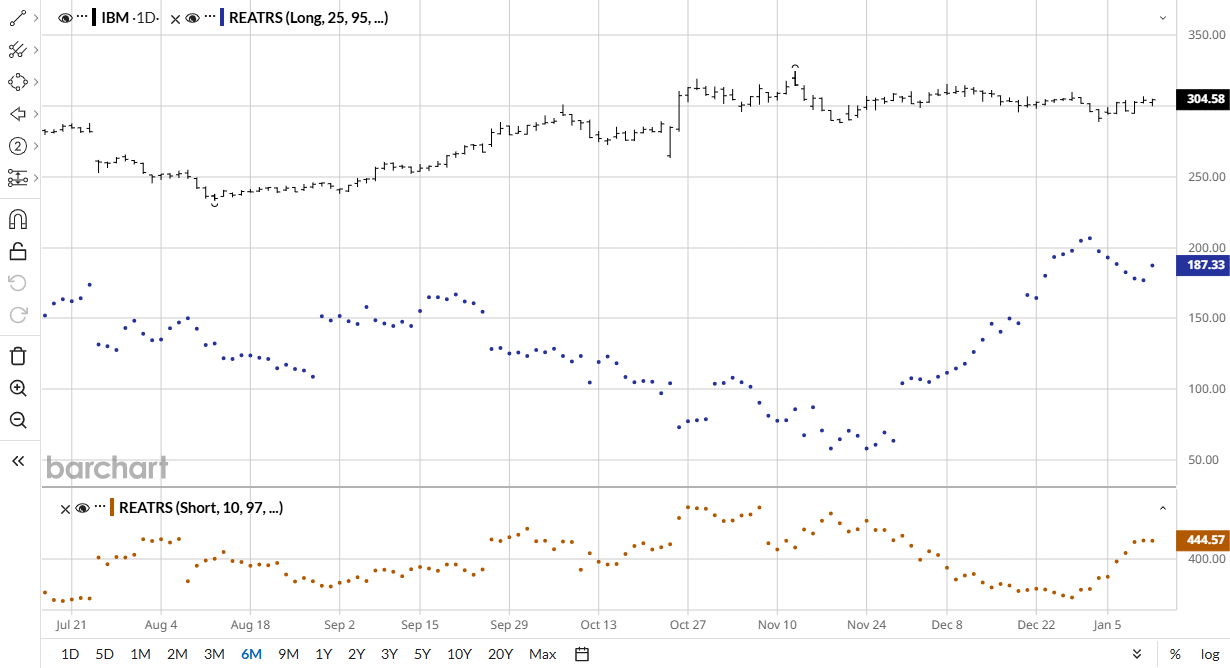

70 would mean that over the past year 252 trading days the current value is higher than 70 of the observations. We can use Barcharts Stock Screener to find other stocks with high implied volatility. Barchart lets you screen by IV percentile.

SLW 52 Naturally we are coming into earnings season here so theres a reason that some of these have high IV here eg NFLX announces in a week and a half. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Barchart Trading Signals Barchart Com.

U S Stocks Follow European Stocks Higher

Tastytrade On Twitter Stock Chart Patterns Implied Volatility Finance Investing

Bulbasaur Color Palette Color Palette Bulbasaur Chart

Logos And Marks Vol Iv On Behance Logos Marks Behance

Retracement Atr High Low Barchart Com

Volume And Open Interest Barchart Com

How High Dividend Stocks Steadily Outperform The Rest Of The Market Dividend Dividend Stocks Financial Markets

Highest High Lowest Low Barchart Com

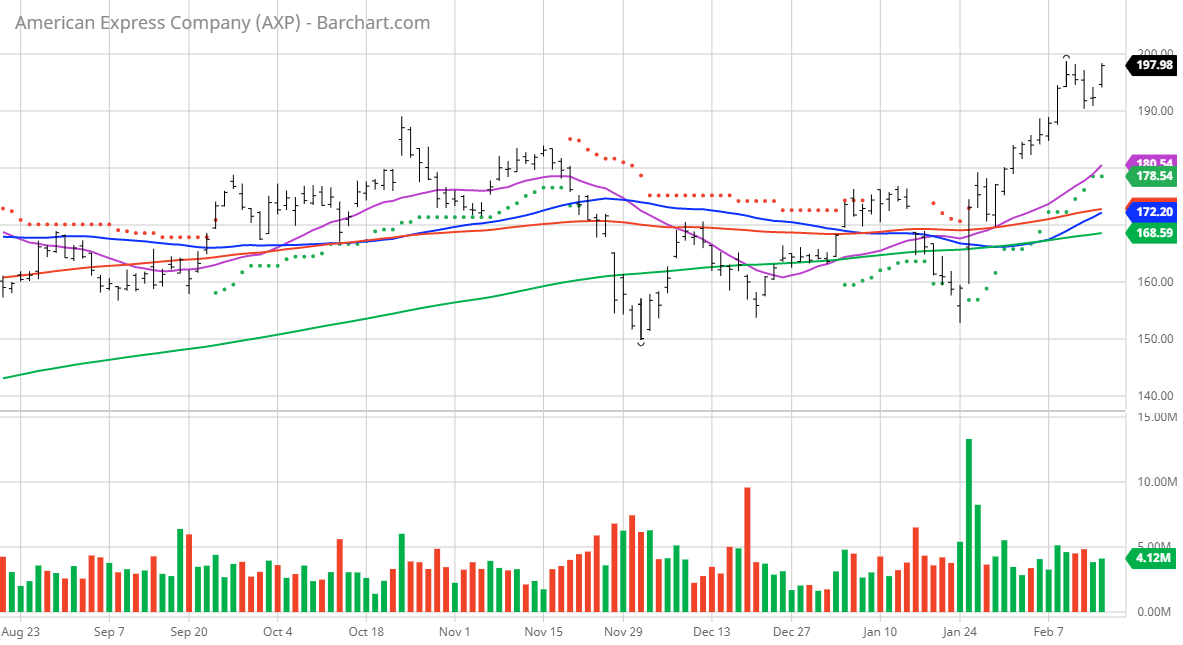

Chart Of The Day American Express Near All Time High

Watchlist Option Alpha Option Trading Implied Volatility Ishares

Consistent High Volatility Stock Screen For Day Traders

Dividend Stocks Are The Worst Meb Faber Research Stock Market And Investing Blog Optiontradingforaliving Stock Options Trading Stock Options Dividend Stocks

Din A3 Technical Drawing Format And Folding Technical Drawing Drawing Sheet Samsung Galaxy Wallpaper

Michael Hart On Twitter Options Trading Strategies Option Strategies Trade Finance

Dividend Stocks Are The Worst Meb Faber Research Stock Market And Investing Blog Optiontradingforaliving Stock Options Trading Stock Options Dividend Stocks

/dotdash_INV_final-52-Week-Range_Feb_2021-01-ea7af056b29e412f86eb714c23c0e4a9.jpg)